What is the Elliot Wave theory in stock market investment?

It’s all about market structure, psychology, and cyclical waves regarding this popular technical trading strategy. It’s none other than Elliott Wave Theory which has been as popular now as it was back in the 1930s when it was introduced.

History

Ralph Nelson Elliott, an accountant and avid stock market participant from the US, developed the wave principle in the early 1930s by studying 75 years of stock market data. The focus of Elliott’s theory was that stock market patterns are fractal and that these stock market patterns follow predictable, natural laws and can be measured and predicted using Fibonacci numbers. Elliott’s theory first received notoriety when Elliott predicted the stock market bottom in the mid-1930s by using his method, to everyone’s surprise.

By the 1940s, Elliott expanded his theory to include all collective human behaviour in the stock market with his publication, Nature’s Law –The Secret of the Universe, published in June 1946, seen as his most comprehensive addition to his theory of market forecasting at the time.

Today we look to R.N Elliott’s Masterworks: The Definitive Collection, published in 1994, which showcases all of Elliott’s work in one publication.

What is Elliott Wave Theory?

Simply put, Elliott Wave Theory suggests that price movements in the stock market are driven by investor sentiment, which forms wave-like patterns in the market. These wave-like patterns are repetitive or fractal and provide a probable scenario in stock price behaviour.Technical analysts use these waves to determine the direction of prices in the stock market. Elliott Wave Theory comprises two primary waves: motive or impulse waves and corrective waves.

Motive Wave and Corrective Waves:

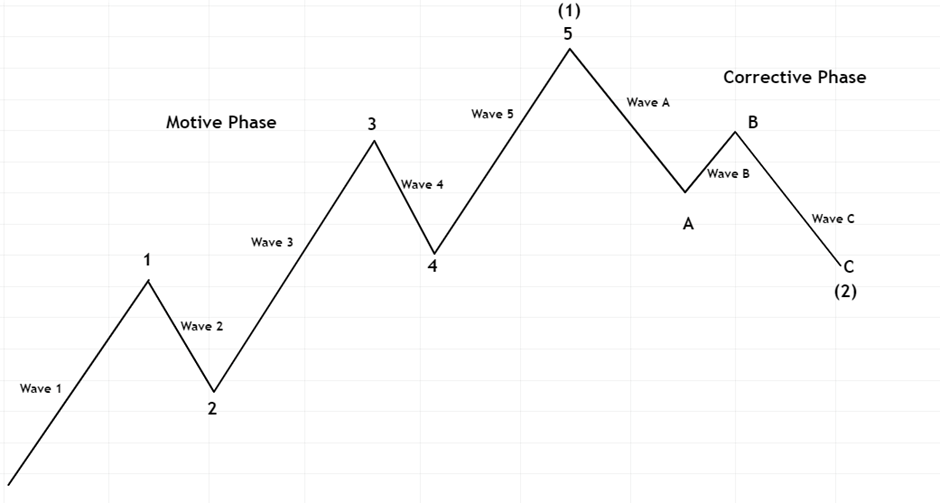

The motive or impulse waves consist of five waves comprising three impulse waves that occur in the direction of the trend labelled as 1,3, and 5 and two corrective waves in the opposite direction of the trend shown as 2 and 4.Corrective Waves are in the opposite direction than the primary trend and consist of three waves depicted on the chart below as A, B and C. Wave A and C are seen as impulse waves, while wave B is a corrective wave.

The chart below shows a complete Elliott Wave cycle which consists of eight waves and is made up of two distinct phases. The five-wave motive phase (the five), whose sub-waves are designated by numbers and the three-wave corrective phase (the three), whose sub-waves are shown as letters.

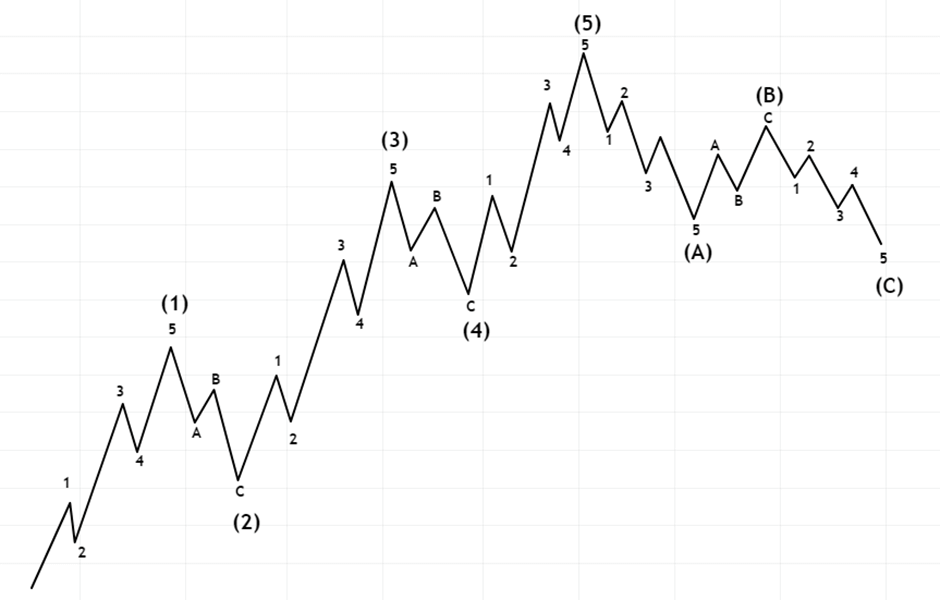

Within the primary eight-wave cycle, as shown above, similar cycles ensue within each eight-wave cycle with a smaller version of itself, as shown in the chart below.

Elliott Wave Theory Mechanics

Diving in and looking closer at the different wave mechanics, we can see that there are specific parameters or rules the waves have to meet within the impulse and corrective phases. When looking at the primary 1,2,3,4,5 motive wave, we must see that wave 2 does not retrace 100% of the first wave. The third wave is the largest of the impulse waves and larger than waves 1 and 5, while wave 4 also can’t retrace more than the start of wave 3.Corrective waves could get tricky as corrective waves have a lot more variety and need to be more clearly defined than motive waves. There are five different types of corrective waves within the Elliott Wave Theory, each with its own rules and subsets. The five corrective waves are:

- Zigzag (5-3-5)

- Flat (3-3-5)

- Triangle (3-3-3-3-3)

- Double three, which is a combination of the two corrective waves above.

- Triple three is a combination of the three corrective waves above.

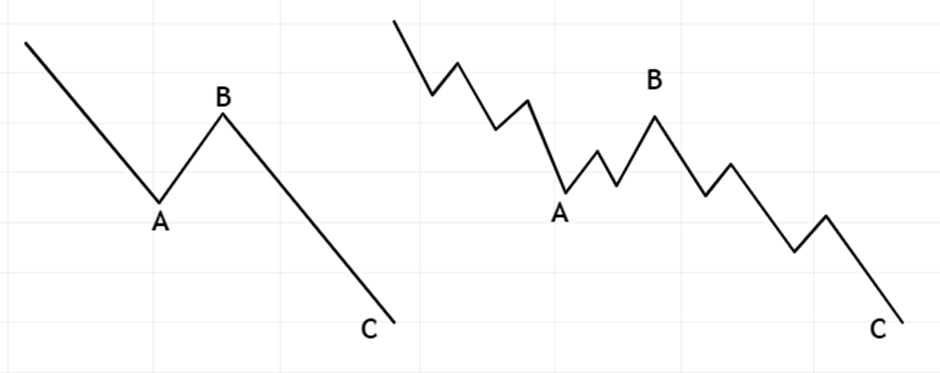

Let’s take a closer look at one of the corrective waves called the Zigzag:

When looking at the zigzag corrective wave in a bull trend, as shown in the chart below, we can see a simple three-wave declining pattern labelled A, B, and C. What distinguishes this corrective wave from the others is the sub-wave sequence 5-3-5 and that the top of wave B is much lower than the start of wave A.

How to use Fibonacci with Elliott Wave Theory?

The Relationship of Fibonacci Ratios with Elliott Wave Theory determines and measures the retracement and extension of price within the Elliott Wave Theory structure. Fibonacci levels to watch within the impulse wave sequence are (according to Elliot Wave Theory):- The second wave is typically 50%, 61.8%, 76.4%, or 85.4% correction of wave 1.

- Wave 3 is usually 161.8% of wave 1.

- The fourth wave typically retraces 14.6%, 23.6%, or 38.2% of the third wave.

- The fifth wave is typically inverse 1.236 – 1.618% of wave 4, equal to wave 1 or 61.8% of wave 1+3.

- Corrective wave B is usually 50%, 61.8%, 76.4% or 85.4% of wave A.

- Wave C usually equals the golden ratio at 61.8%, 100%, or 123.6% of wave A.

- If wave C equals 161.8% of wave A, wave C can be wave 3 of a 5 waves impulse.

Summary

We have only scratched the surface with Elliott Wave Theory in this content piece, as the popular technical analysis strategy has many more mechanics to mention. Technical analysts have used the technique for decades, which shows the validity of the cyclical nature of the wave principle.This material (whether or not including any opinion) is provided for information purposes only and does not take into account any individual’s personal circumstances or investment objectives. Nothing contained in this material is or should be considered to be financial, investment or other advice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

No comments

Home

Trive

TriveHub

0 comments