How can I safeguard my investment during a recession?

Recession Trading Strategies, Safeguarding Your Investments

The word “Recession” has been synonymous with negativity since the dawn of time, and when you hear the “R” word, the first words that usually come to mind are “Oh no!”. But relax; it’s not all doom and gloom, and here is why:

What is a Recession?

According to the National Bureau of Economic Research, a recession is when economic activity declines for over two consecutive quarters. When the Gross Domestic Product (GDP) declines, real income, consumer spending, industrial production, and employment fluctuate.Causes and Effects of a Recession

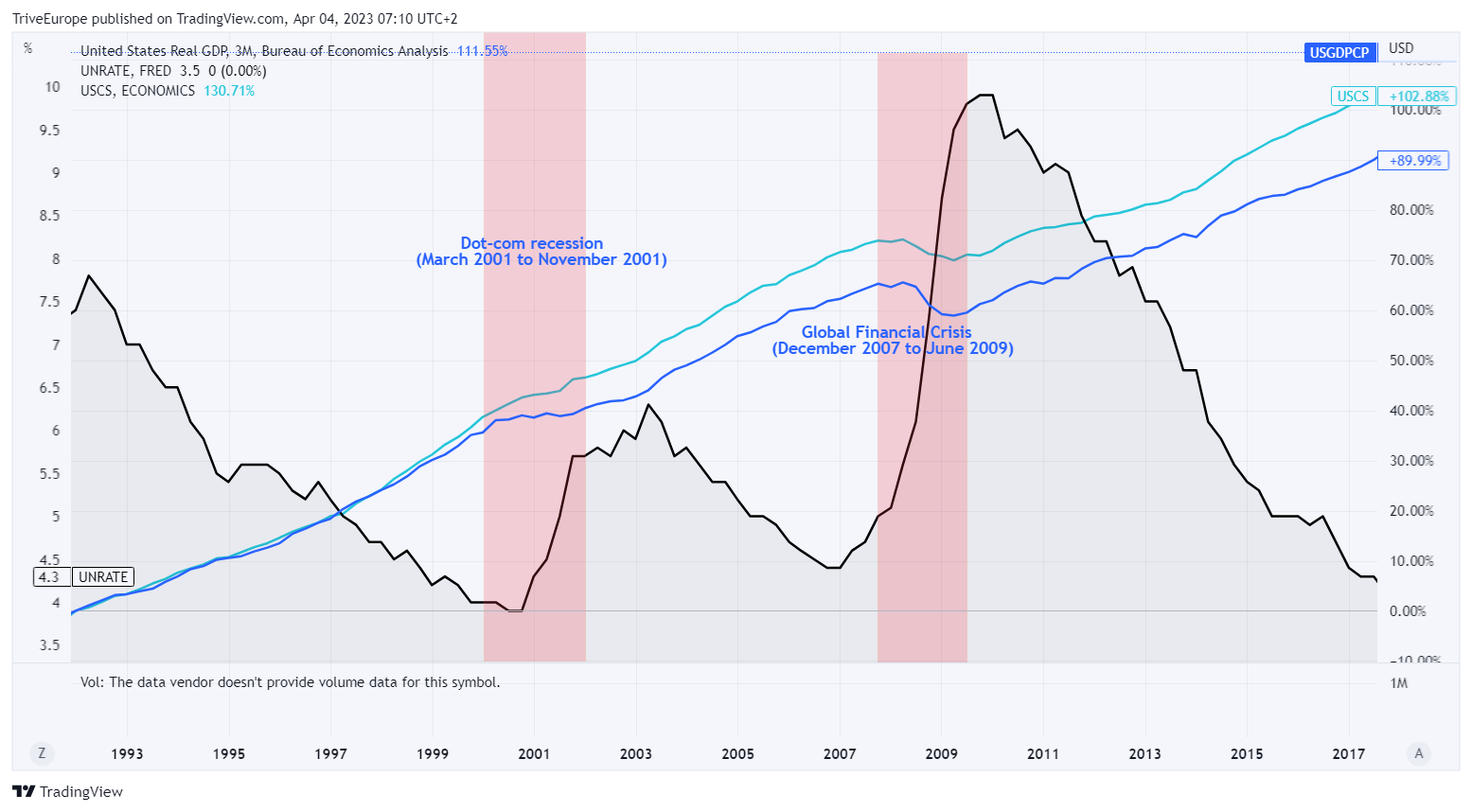

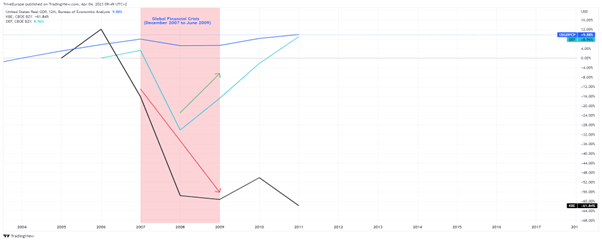

Recessions are caused by economic shocks, speculative asset bubbles bursting, or rising debt, among other factors. The more recent and notable recessions occurred in 2008 and 2001.The 2008 Global Financial Crisis was caused by a housing market bubble catalysed by low-interest rates and bad credit. When the bubble finally burst, a recession was in full swing lasting 18 months. GDP fell 4.3%, and unemployment rose to 10%, while the U.S. Government injected $700B as a bailout package for the failing banks of the time.

The DOT-COM Recession of 2001 had similar traits to the Global Financial Crisis but was caused by an over-inflated Nasdaq Index, which declined 75% and totalled tech investor’s capital. Due to the recession being somewhat contained to the effects of losses in the stock market, it lasted only eight months, with GDP contracting 0.6% and unemployment reaching 5.5%.

In the above illustration above, U.S. Real GDP (USGDPCP) is tracked against Consumer Spending (USCS) and the Unemployment Rate (UNRATE). The 2008 Global Financial Crisis saw a huge surge in unemployment while consumer spending dipped.

Why Recessions are Not the End of the World

Understandably, no one wants a recession; however, certain risk approach may be useful when attempting to safeguard some investments.

During a recession, equities take a knock. This is due to the decline in real incomes and consumer spending, which leaves public companies competing for less. Businesses are subsequently forced to reduce prices in some instances to attract customers, thereby further exacerbating their revenue loss.

However, not all sectors are prone to lose out. Some sectors perform better than others in a recession, and we will explore some of them.

During an economic recession, defensive stocks tend to perform between stable to positive and usually outperform other sectors. Defensive stocks sell necessities or essentials, such as food, drugs, medical supplies or energy. Households typically allocate a budget to these even when their real income is declining.

Cyclical stocks tend to align with the economy as they grow in demand when the economy expands and vice versa. For example, recessions usually come with low-interest rates to stimulate economic growth with cheaper borrowing costs. Financial services companies that rely heavily on interest income could suffer declining revenues and earnings, making them less attractive investments. In addition, with lower disposable income across households, airline, travel, and hospitality sectors suffer losses as households generally cut back on non-essential spending, making stocks in this sector less attractive.

SPDR S&P Bank ETF (KBE) and Invesco Defensive Equity ETF (DEF) are two ETFs which track cyclical and defensive stocks, respectively. The illustration below shows that defensive stocks outperform cyclical stocks during a recession.

What About Other Asset Classes?

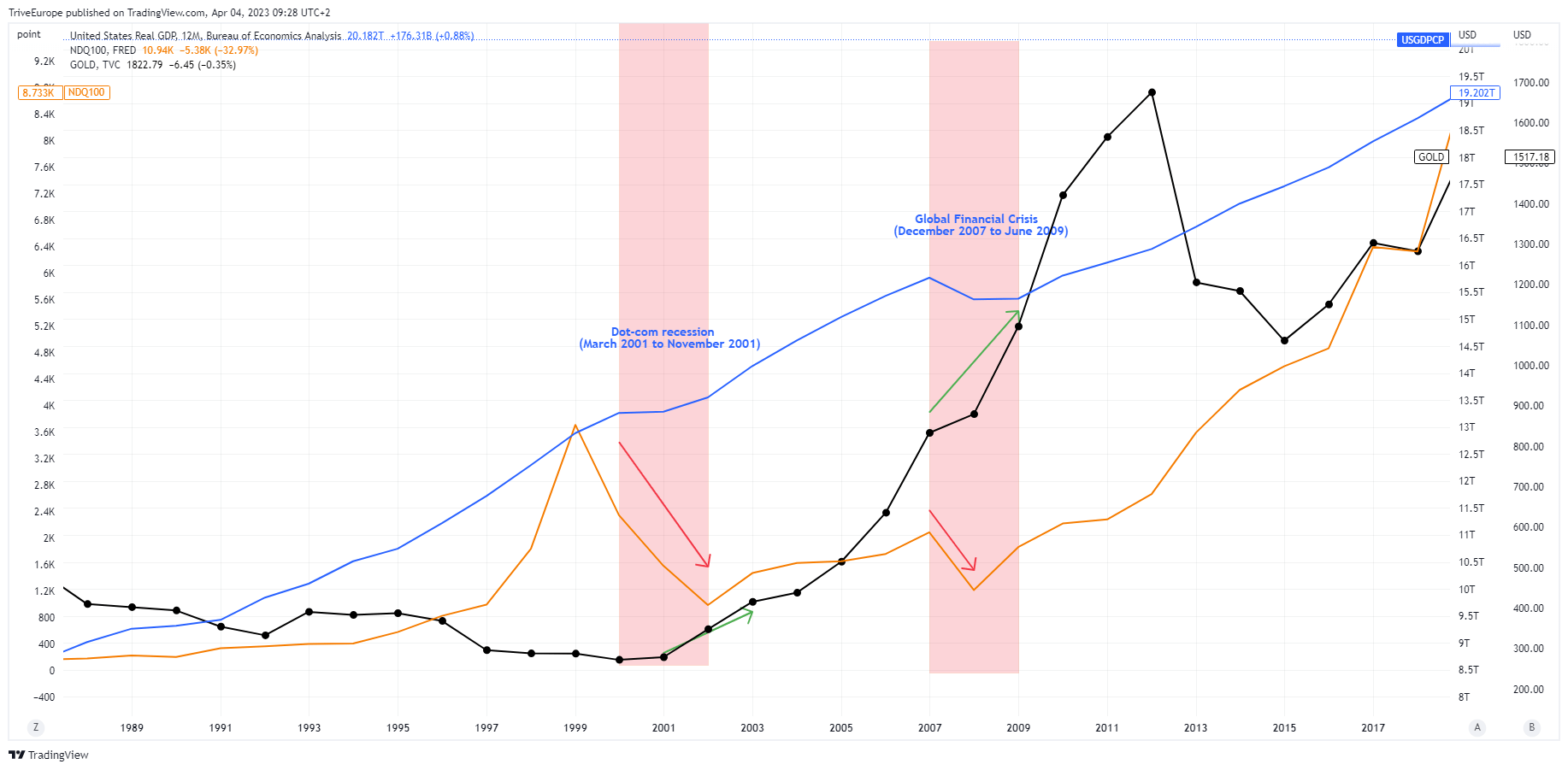

Gold, which is generally considered by experts as a safe-haven investment, tends to outperform during times of economic downturn. Due to the value of other assets declining, Gold is viewed as a store of value, and its demand generally peaks during recessions. The illustration below shows that Gold picks up steam as a recession unfolds. Gold shot up almost 18% during the 2008 Global Financial crisis, while the Nasdaq100 dipped 9.36%.

Bonds prices often move higher as demand for them increases. Central Banks normally encourages low-interest rates to stimulate growth during a recession. Older bonds which offered higher yields and were issued before the recession are sought after due to their more lucrative income-generating capability over newer issued bonds with low-interest rates.

Financial derivative instruments might be a good way to mitigate risk during a recession. Derivative instruments allow the investor to go long (buy) or short (sell) various asset classes like some sector ETFs or CFDs.

Gold, Defensive Stocks and Bonds may be considered for mitigating investment risks derived from long positions during a recession. On the opposite, cyclical stocks remain under pressure when a recession unfolds until the macroeconomic picture changes, so may be considered when deciding to go short during a recession as their value generally declines.

No comments

Home

Trive

TriveHub

0 comments