How can I place multiple orders with the grid trading strategy?

Grid trading is a popular trading strategy that involves placing multiple orders on a currency pair or other financial instrument with the aim of profiting from price movements. This strategy is based on the idea of creating a “grid” of orders at different price levels, with the hope that as the price moves up and down, some of these orders will be executed and generate profits.

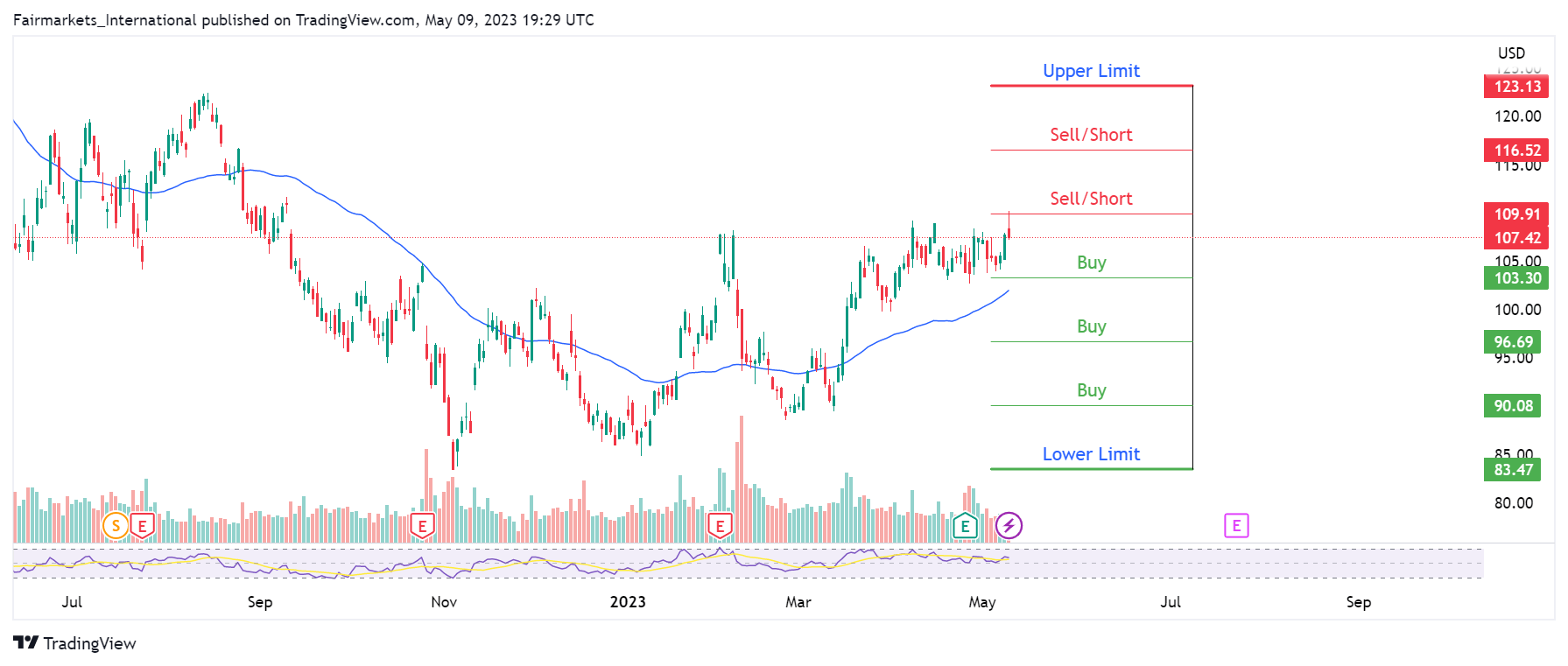

The basic principle behind grid trading is that the trader creates a series of buy and sell orders at specific intervals above and below the current market price. For example, let’s look at Alphabet Inc. (NASDAQ: GOOGL), whose current market price is $107.47. The trader might place sell orders above the current market price at $109.91, $116.52, and $123.13 and buy orders below the current market price at $103.30, $96.69, and $90.08. As the price moves up and down, some of these orders will be executed, generating profits for the trader.

One of the key benefits of grid trading is that it is a low-risk strategy, as the trader can set up the grid so that profits are made in both rising and falling markets. Additionally, grid trading allows traders to take advantage of market volatility, as profits can be made from small price movements in either direction.

However, there are also some risks associated with grid trading. If the price of the financial instrument being traded remains flat, the trader may not be able to generate any profits from the grid. Additionally, if the price moves in one direction only, the trader may end up with a large number of unexecuted orders, resulting in significant losses.

To be successful with grid trading, it is important to have a solid understanding of market trends and to be able to identify price levels where orders should be placed. Additionally, traders must be disciplined and patient, as it can take some time for the price to move in the desired direction and for profits to be generated.

There are several tools and indicators that can be used to help with grid trading, including trend lines, moving averages, and Fibonacci retracements. These tools can help traders to identify key price levels and to determine the optimal intervals for placing buy and sell orders.

When implementing a grid trading strategy, it is important to carefully consider the size of each order and the overall size of the grid. Traders should also set stop-loss orders to limit potential losses and should regularly review and adjust their grid to ensure that it is still effective.

In conclusion, grid trading is a popular trading strategy that can be used to generate profits from market volatility. While there are some risks associated with this strategy, it can be a low-risk way to profit from small price movements in either direction. To be successful with grid trading, it is important to have a solid understanding of market trends and to be disciplined and patient in implementing the strategy.

No comments

Home

Trive

TriveHub

0 comments